The Network Economy And The Boundless World Of ‘More is Merrier’

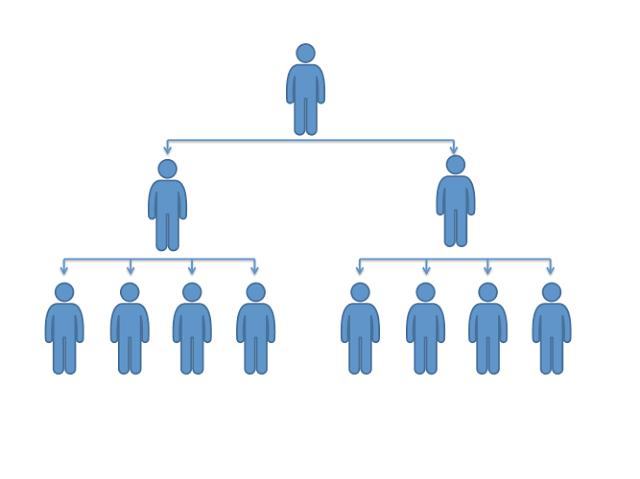

Amazon’s boxes are building our world. It is a behemoth in the network economy. But the networked economy is a part of the networked world. In every way, we are reliant on networks. Phone networks, web networks, social networks, alumni networks, capital networks, official networks, political networks, religious and spiritual networks. Networks have peculiar economic characteristics. This is easiest to see in products like the telephone, fax, a PC, the local courier operation or the internet. One phone or fax or email address is useless. Two units have some value. Thereafter, any increase in the network size has a more than proportionate increase in value to each user. [siteorigin_widget class=”SiteOrigin_Widget_Image_Widget”][/siteorigin_widget] Bob Metcalfe, the inventor of Ethernet postulated the Metcalfe’s law in 1980 : the value of a network equals n squared (n X n), where n is the number of people in the network. Thus a 5-person network is worth 25, but a 10-person network is worth 100. A linear increase in membership means an exponential, geometric increase in value. Network economics therefore exhibits an extreme form of increasing returns, both for all members of a network and for leading suppliers to the network. An expanding network becomes a self-reinforcing virtuous circle. Each new member increases the network’s value, which in turn attracts new members. Generally, network members are unpaid but well rewarded evangelists of the network. Networks typically spend quite a while reaching their tipping point, and then there is no stopping them. Traditionally, value comes from having a closed, proprietary system and from scarcity. No more. With networks, value comes from openness and from proliferation. The more allied it is with other networks, the more valuable a network becomes. The gain in coverage and value creation far exceeds a loss in the exclusivity of value capture. The more you have, the more you want – the exact opposite of diminishing utility. The more we make, the easier and cheaper it becomes to make more. This is the beauty of network economies. It is both deflationary such that prices come down for ever and expansionary such that more and more useful things are created and used. The frothy excitement from investors in general and markets across the world to the possibilities that networks provide has led many observers to feel that leading players can come close to generating almost infinite returns. One reason is the share of low-cost of internet transactions. As the value of network increases with scale, so the average cost of enabling software declines. The marginal cost is almost zero. Non-network businesses may have high fixed cost, but the marginal cost of meeting customer demand never falls to zero – After all sales, marketing and customer service are all fairly extensive operations. By contrast, networks – and in particular- the internet may add customers and sales at negligible extra cost. The world was disrupted by Amazon. This was because the Internet allowed Amazon to separate information flows from physical flows. A store that sells books is a physical entity that has inventory as well as an area of exhibition where what’s on the shelves is available and consumers may interact with it in shop. But the internet separates the two – the storefront supplied the information without any involvement of physical flows and therefore it could have huge stocks with zero inventory, thus pole vaulting over the traditional trade-off between cost and choice. It also created the live reality that consumers of information also became unpaid producers of information. Being adaptive, the cost of cross selling different products decreased dramatically with the internet. When one is selling a flight ticket, one can very easily sell hotel rooms, travel insurance, car hire and umpteen other services. The value of a loyal customer base becomes multiplied by an engaged loyal following. Network effects are reaching across the business world. An array of traditional and new companies have put network thinking at the core of their business model. The results have been a mixed bag but it is clear that the pace of evolution of technology affords us no luxury of a U-turn. The birth of millions of new online companies and the transformation of existing businesses has been made possible thanks to the Internet. Networks have enabled existing organisations to adapt to the rapidly changing market conditions. The new internet world has given new meaning to ‘share’, ‘search’, ‘like’, ‘connect’ and ‘viral’. The durability of capitalism has been based on its inherent adaptability. So long as sanctity of contract, private property, profit and growth are intact and can align with privacy and democracy we shall find a better world via the internet. http://www.businessworld.in/article/The-Network-Economy-And-The-Boundless-World-Of-More-Is-Merrier-/09-11-2020-340714/

The Network Economy And The Boundless World Of ‘More is Merrier’ Read More »