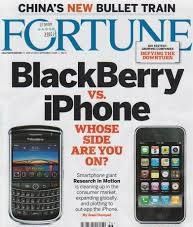

In 2008, BlackBerry (then known as Research In Motion) had a market value that exceeded the then combined (yes combined!) market value of NVIDIA, AMD, Amazon, Netflix,Salesforce, and Starbucks.

Get your mind to absorb that….

This is exactly 17 years ago….

BlackBerry, founded in 1984 by a pair of engineering students, Mike Lazaridis and Douglas Fregin, was for years one of the world’s most innovative builders of communications products like two-way pagers and e-mail devices.

In 2008, BlackBerry (then known as Research In Motion) reached its peak market capitalization of approximately $75 billion, driven by the popularity of its smartphones among business users and government agencies.

At its peak, Blackberry owned over 50% of the US and 20% of the global smartphone market, sold over 50 million devices a year.

The all-time high BlackBerry stock closing price was 147.55 on June 19, 2008.

By the end of that year, amid the global financial crisis and intensifying competition from emerging smartphones like Apple’s iPhone, BlackBerry’s market cap had declined significantly.

On December 31, 2008, it stood at $23.3 billion, based on a share price of $40.58.

In contrast, Apple’s market capitalization at the end of 2008 was approximately $75.99 billion.

While BlackBerry’s market cap at its peak in 2008 was roughly equal to Apple’s at the end of that year, by December 31, 2008, Apple’s market cap had far surpassed BlackBerry’s value.

That’s how fast it happened and the rest is history …

hashtag#brand hashtag#disruption hashtag#obsolescence hashtag#technology hashtag#blackberry hashtag#businesshistory